The Mistral well encountered a 46-metre gas/condensate column in a sandstone reservoir with good reservoir properties. As part of the drilling operations, an extensive data collection programme was carried out, which will be used to conduct further studies of the reservoir and fluid properties.

7 discoveries out of 9 wells

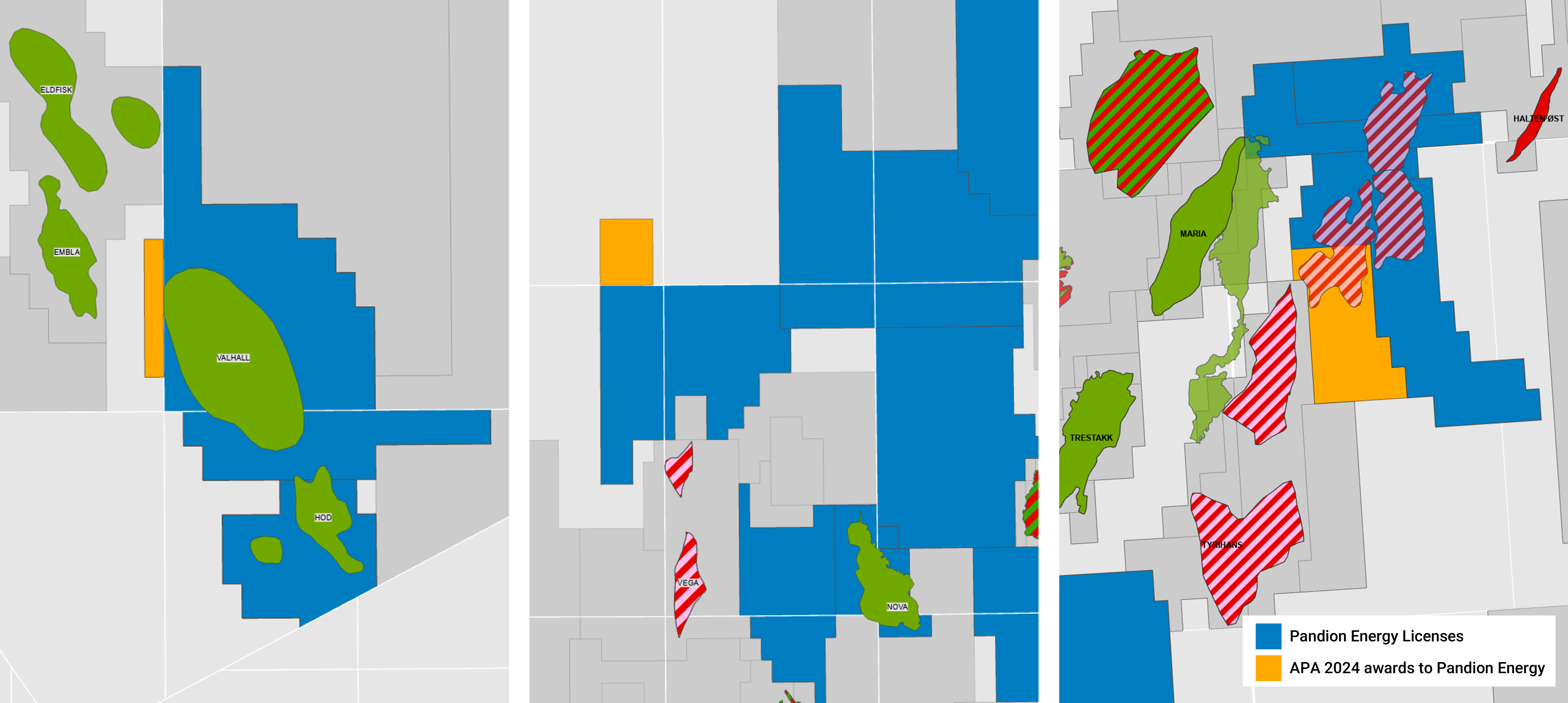

This well marks the seventh discovery for Pandion Energy out of a total of nine exploration wells drilled since the company’s inception in 2016. The Mistral discovery is located in the neighbouring license to the Tyrihans subsea field in the Norwegian Sea, and close to several other producing fields, including Åsgard and Kristin.

VP Exploration & Appraisal, Bente Flakstad Vold states:

This discovery strengthens our presence in this mature part of the Norwegian Sea and illustrates our approach to exploration in selected areas near existing infrastructure. I am very proud of the team at Pandion Energy, which has delivered a discovery rate of around 80 percent so far. We now look forward to maturing the Mistral discovery further together with the operator Equinor and partners OKEA and DNO.

High activity in 2025

Mistral is one of two exploration wells for Pandion Energy in 2025. The Horatio well in production license 1109, where the company holds a 20 percent interest, was spudded in early February.

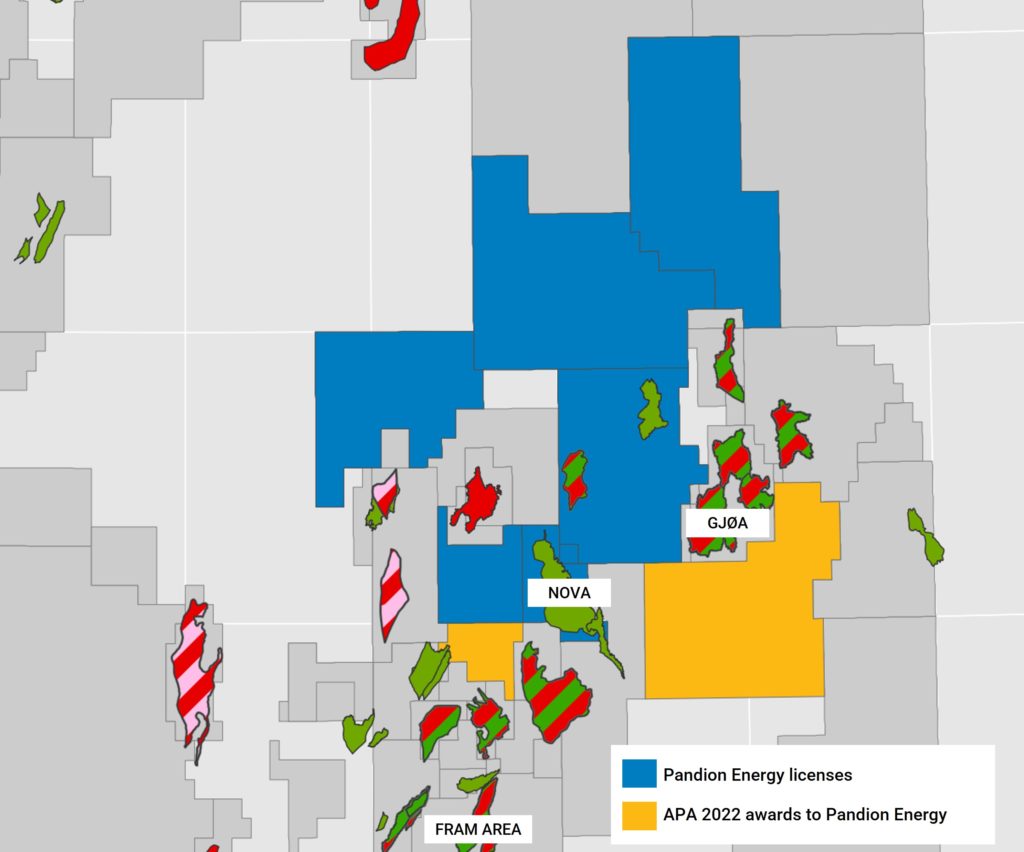

Pandion Energy is also actively working on maturing its other discoveries. These days the company is preparing for the appraisal campaign on the Slagugle discovery in production license 891 in the Halten Bank area in the Norwegian Sea. The company is also actively involved in maturing the Ofelia discoveries made in 2022 and 2023 in production license 929 in the Greater Gjøa area in the northern North Sea. This project passed the decision to concretize in December 2024 and together with operator Vår Energi and the other partners, the company is planning to submit a Plan for Development and Operation by the end of the year.

Additionally, the jacket for the new central production and wellhead platform (PWP) will be installed on the Valhall field during the third quarter. PWP is part of a joint development project with Fenris (formerly King Lear), located in the southern part of the North Sea. Pandion Energy AS is a partner in the Valhall license, where Aker BP is the operator.