The Ofelia well, 35/6-3 S encountered oil in the Agat formation. The preliminary estimate of recoverable oil volume is in the range of 2.5-6.2 million standard cubic meters (MSm3) or 16-39 million barrels of oil equivalent (mmboe). An additional upside of around 10 mmboe recoverable gas in the shallower Kyrre formation north of the well, brings the total recoverable volume to approximately 26-49 mmboe. The Ofelia drilling program confirmed an oil/water contact at 2,639 metres total vertical depth.

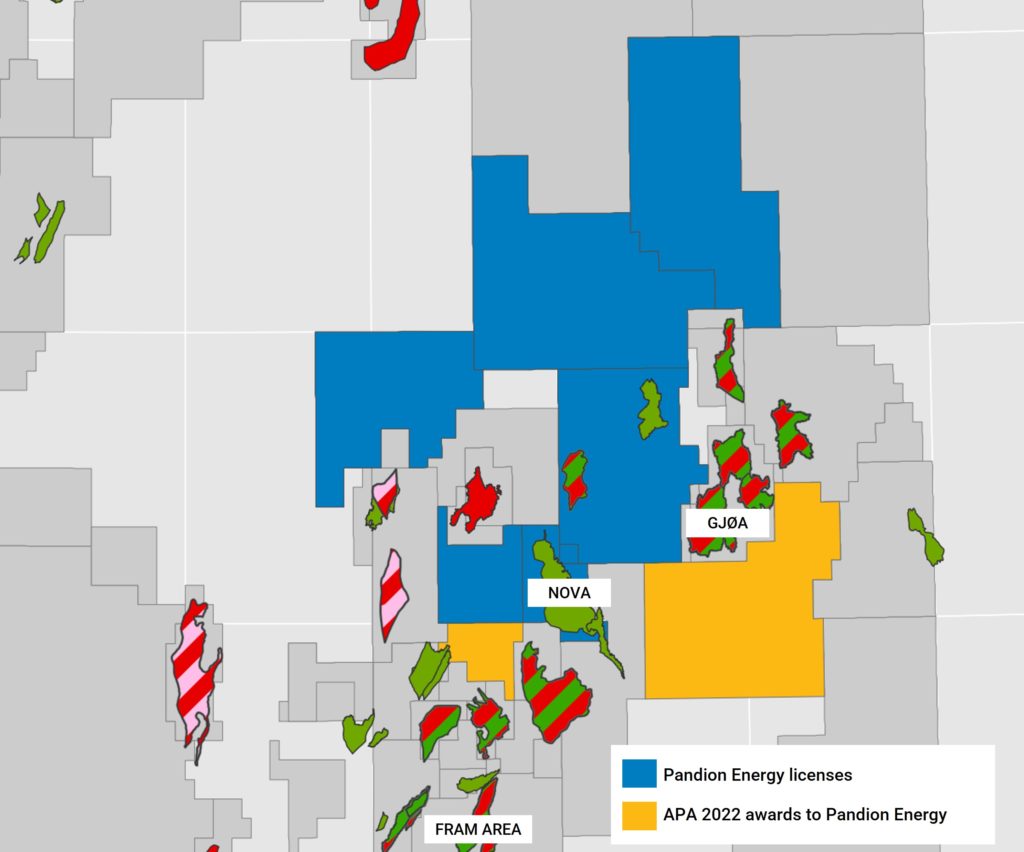

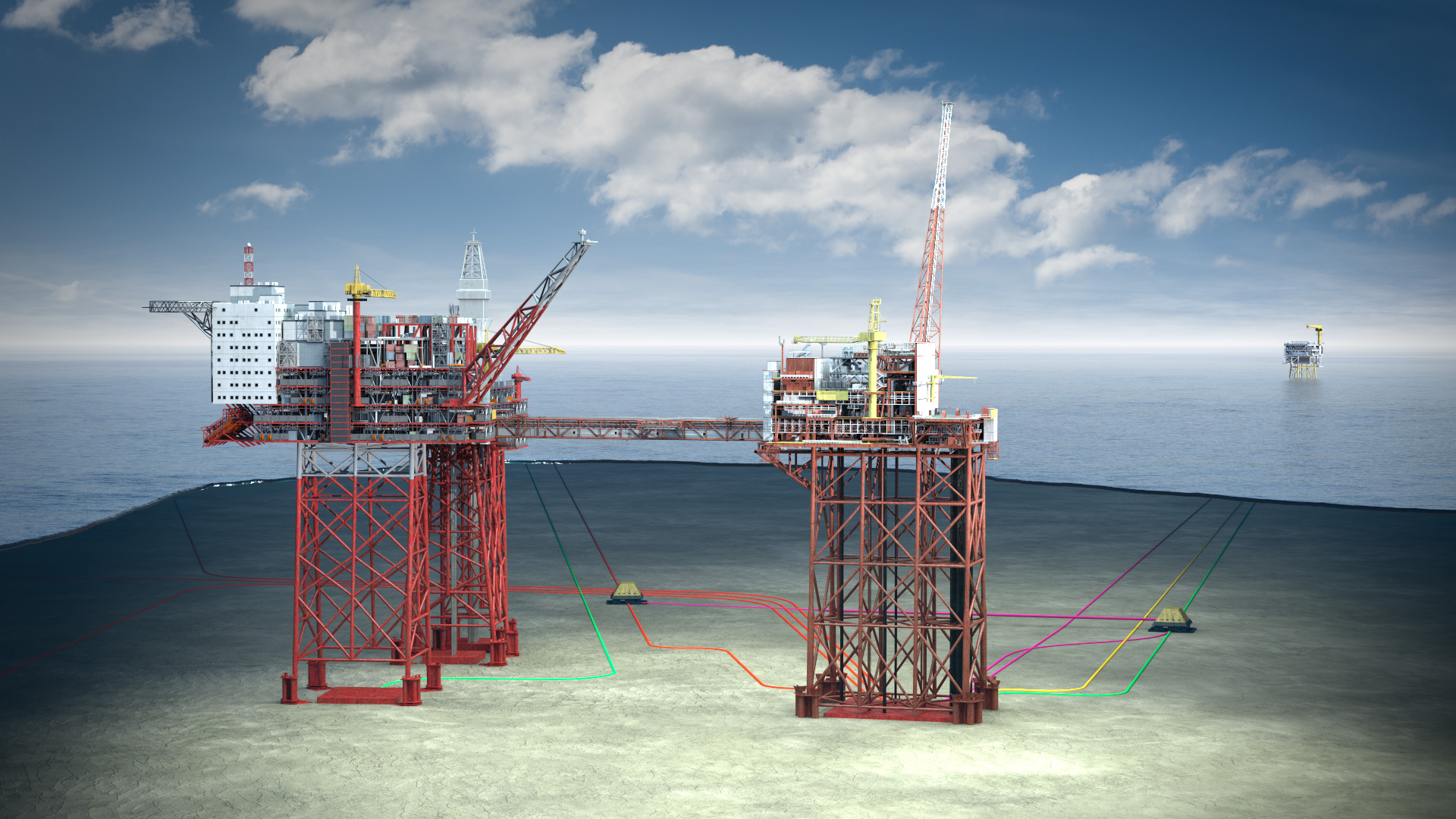

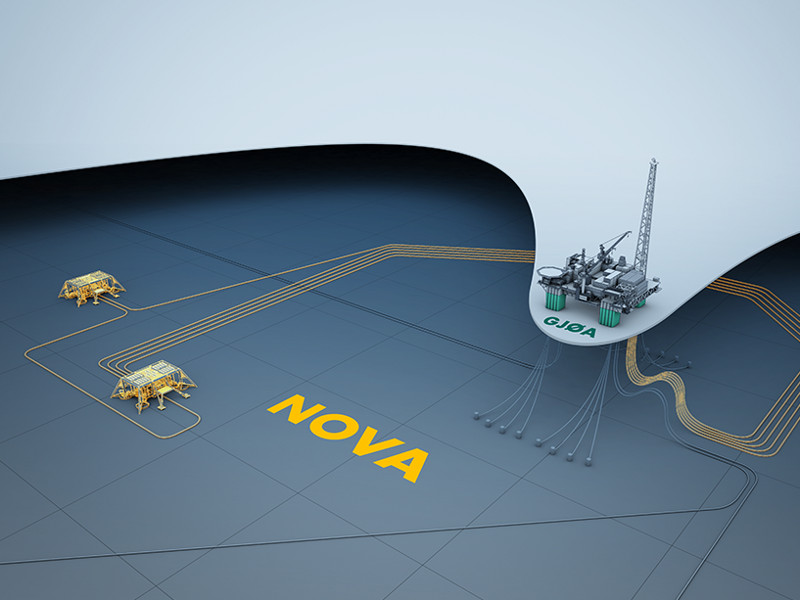

The discovery is located 15 kilometres north of the Gjøa platform, also operated by Neptune Energy. Ofelia will be considered for development as a tie-back to the Gjøa semi-submersible platform in parallel with the recent Hamlet oil and gas discovery. Gjøa is electrified with power from shore and produces at less than half the average carbon intensity of Norwegian Continental Shelf fields*.

Jan Christian Ellefsen, CEO of Pandion Energy said:

With this discovery Pandion Energy further manifests its presence in the Greater Gjøa Area and demonstrates the potential of our exploration strategy focusing on opportunities close to existing infrastructure. I’m also pleased to see that we are able to deliver profitable growth while remaining loyal to our Net Zero Carbon strategy.

Bente Flakstad Vold, VP Exploration and Appraisal, added:

“Our history in this area traces back to the first discovery in Pandion Energy’s portfolio, namely 36/7-4 Cara later renamed Duva. Ofelia was our first APA application building on the experiences made as partner in the area, and demonstrates the exploration team’s ability to deliver organic growth.”

Duva, now on stream, was the first discovery in the Agat formation in this area, a reservoir which until recently was not part of established exploration models on the Norwegian Continental Shelf. Pandion Energy divested its interest in the Duva field in 2020 and is currently partner in several neighbouring exploration licenses. Earlier this year Pandion Energy acquired a 10 per cent interest in the Nova field, which was put on stream in July as a subsea tie-back to Gjøa.

Ofelia was drilled by the Deepsea Yantai, a semi-submersible rig, owned by CIMC and operated by Odfjell Drilling.

Partners: Neptune Energy (Operator, 40%), Pandion Energy (20%), Wintershall Dea (20%), Aker BP ASA (previously Lundin Energy) (10%) and DNO (10%).

For further information see press release from the Norwegian Petroleum Directorate (link) and the operator Neptune Energy (link).

Notes to editors:

* CO2 emissions from Gjøa are estimated at 3kg of CO2 per boe (EnvironmentHub (EEH); CO2 emissions and Diskos; Gross production incl. tie-ins, 2020), average on the Norwegian Continental Shelf is 8 kg CO2/barrel (NOROG Miljørapport 2020).