Jan Christian Ellefsen, CEO of Pandion Energy, stated the following:

During our first five years in operation, we have grown to become a recognized player in exploration and development on the NCS.

”Our 10 per cent interest in the Valhall area gives us daily production of over 5 000 barrels of oil equivalents. In March 2022, we announced the acquisition of the Norwegian operations of Dutch company ONE-Dyas, which represents a new quantum leap in the Pandion Energy story and secures the foundation for further growth.

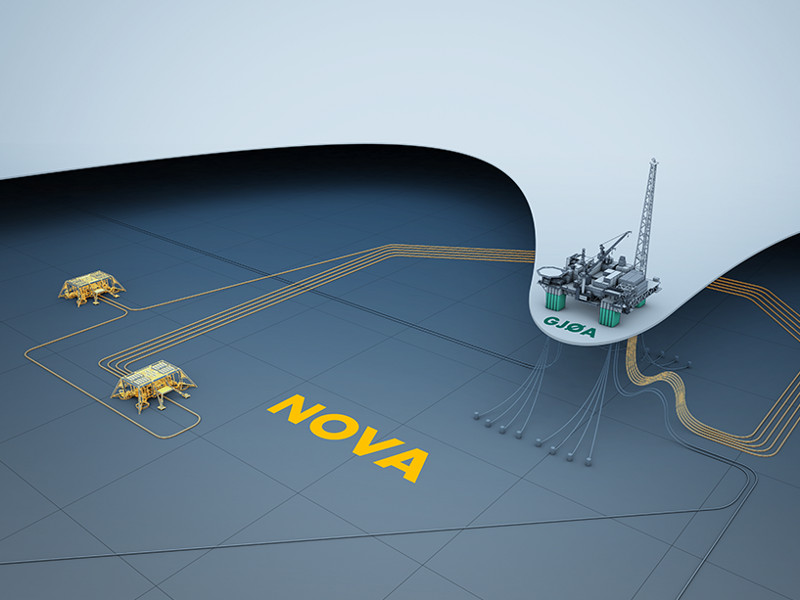

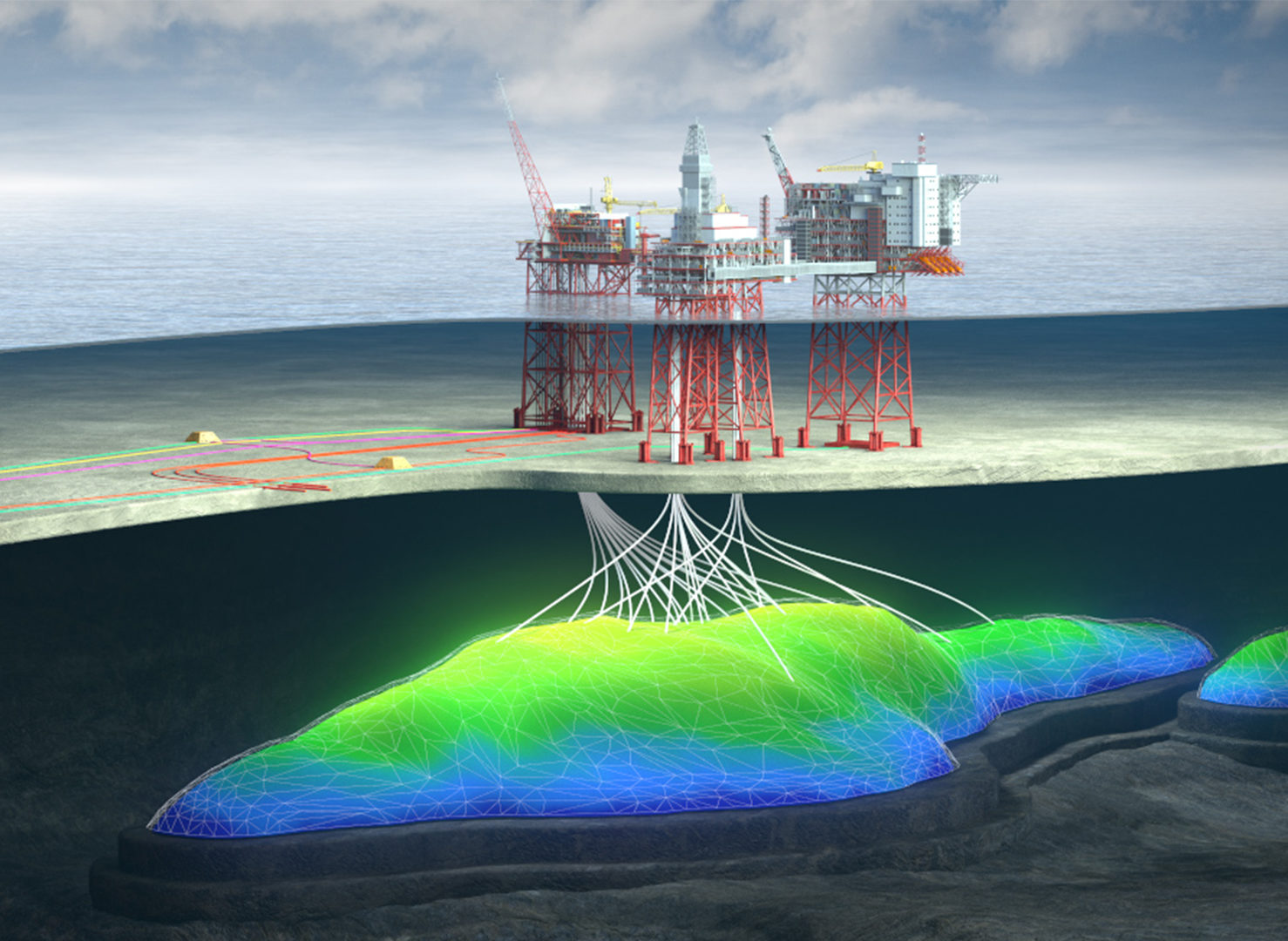

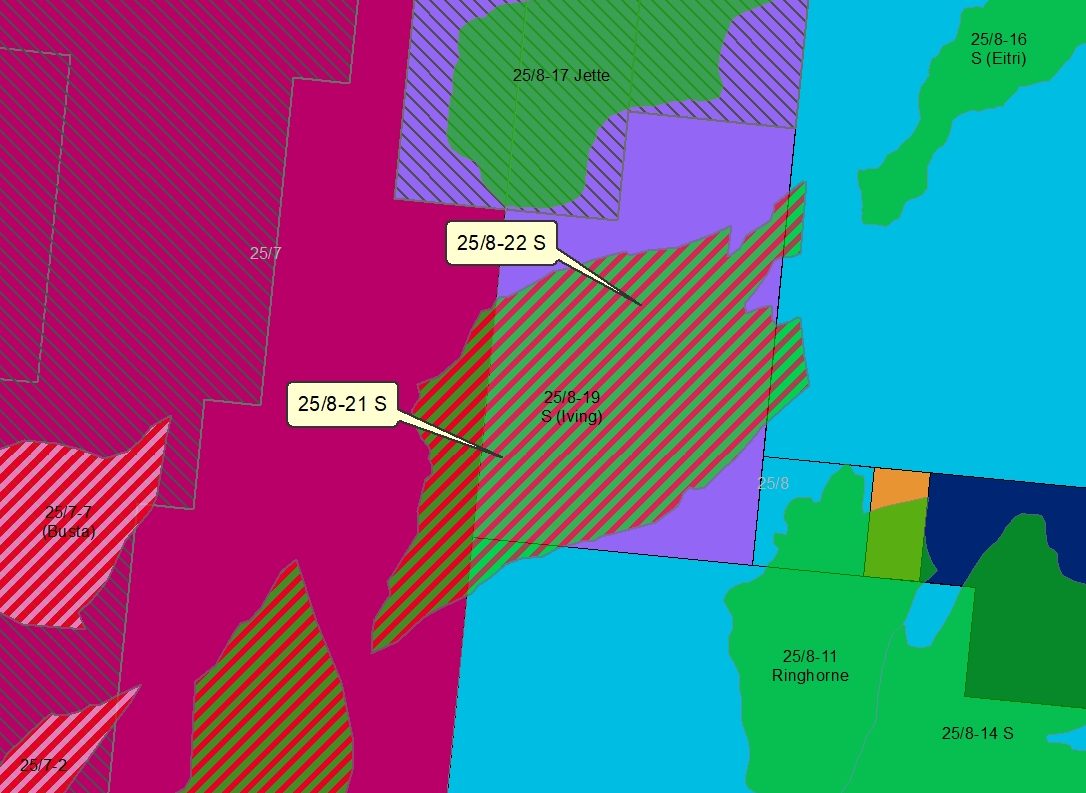

This transaction includes a 10 per cent share of the Nova field, which is planned to come on stream in the second half of this year. When that field reaches plateau output, our daily production will be more than doubled. Also nearly doubling our exploration bank, the ONE-Dyas portfolio fits well with our existing holdings. The Nova development is a subsea infrastructure with a low CO2 footprint, well in line with our ESG strategy.

We are entering 2022 with a strong balance sheet which permits further merger and acquisition activities. We remain committed to our strategy of being an active, responsible partner and a full-cycle oil and gas company with long-term ambitions.”

Total revenues and other income for 2021 amounted to USD 135.9 million (2020:USD 116.6 million) and comprised net sales of oil and gas and gain/loss from hedging positions.

The increase in revenue mainly reflected higher commodity prices combined with larger crude oil volumes sold during the fiscal year. Net sales of oil and gas for the year amounted to USD 137.9 million (2020: USD 76.7 million).

Average net production for Pandion Energy was 5 152 boe per day (boepd), compared with an average of 5 639 boepd in 2020. The reduction in produced volumes was a result of planned downtime related to chalk influx in several wells necessitating well intervention activities.

The board considers Pandion Energy to be well positioned for further growth. The company remains committed to its strategy of being an active and responsible partner on the NCS, participating in every phase from exploration through to the development of oil and gas resources.

The invasion of Ukraine in February has had dramatic consequences which cannot be seen to the full extent at the time of writing this report. Beyond the devastating human suffering, consequences to the world economy and markets are likely to be expected. The extent to which the invasion impacts the company’s results will depend on future developments, which are highly uncertain and difficult to predict, including new information which may emerge on an ongoing basis.

Pandion Energy Combined Annual Report 2021