The wildcat well 6507/5-10 S is located about 23 kilometers north of the Heidrun field in the Haltenbank area, in the central part of the Norwegian Sea.

Preliminary estimates place the size of the discovery between 12 and 32 million standard cubic meters (Sm³) of recoverable oil equivalent, or about 75 to 200 million barrels oil equivalent.

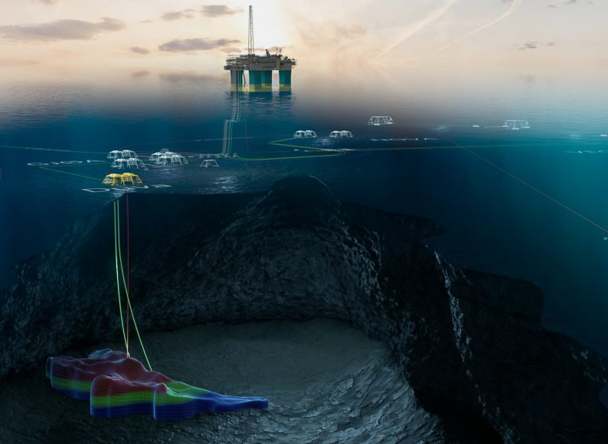

The well encountered a total oil column of 270 metre in the Åre Formation and Grey Beds. Sandstone layers of 90 meters were encountered within the oil column with generally very good reservoir properties.

Pandion Energy, together with operator ConocoPhillips Scandinavia AS, will assess the results of the discovery together with other nearby prospects to determine the future appraisal and potential development solutions.

VP of Exploration and Appraisal at Pandion Energy, Bente Flakstad Vold, comments:

“We are proud to take part in the largest discovery in Norway this year. This illustrates the value creation potential in the team’s ability to make quick decisions based on a multidisciplinary work methodology. In light of the knowledge gathered from the discovery well, we see an exciting resource upside in both the discovery itself and other parts of the license. We now look forward to continuing our good cooperation with ConocoPhillips and contribute to realizing the full value potential in PL 891.”

Pandion Energy acquired its 20 per cent interest in the production license in July 2019 from operator ConocoPhillips, which holds the remaining 80 per cent.

CEO of Pandion Energy, Jan Christian Ellefsen, adds:

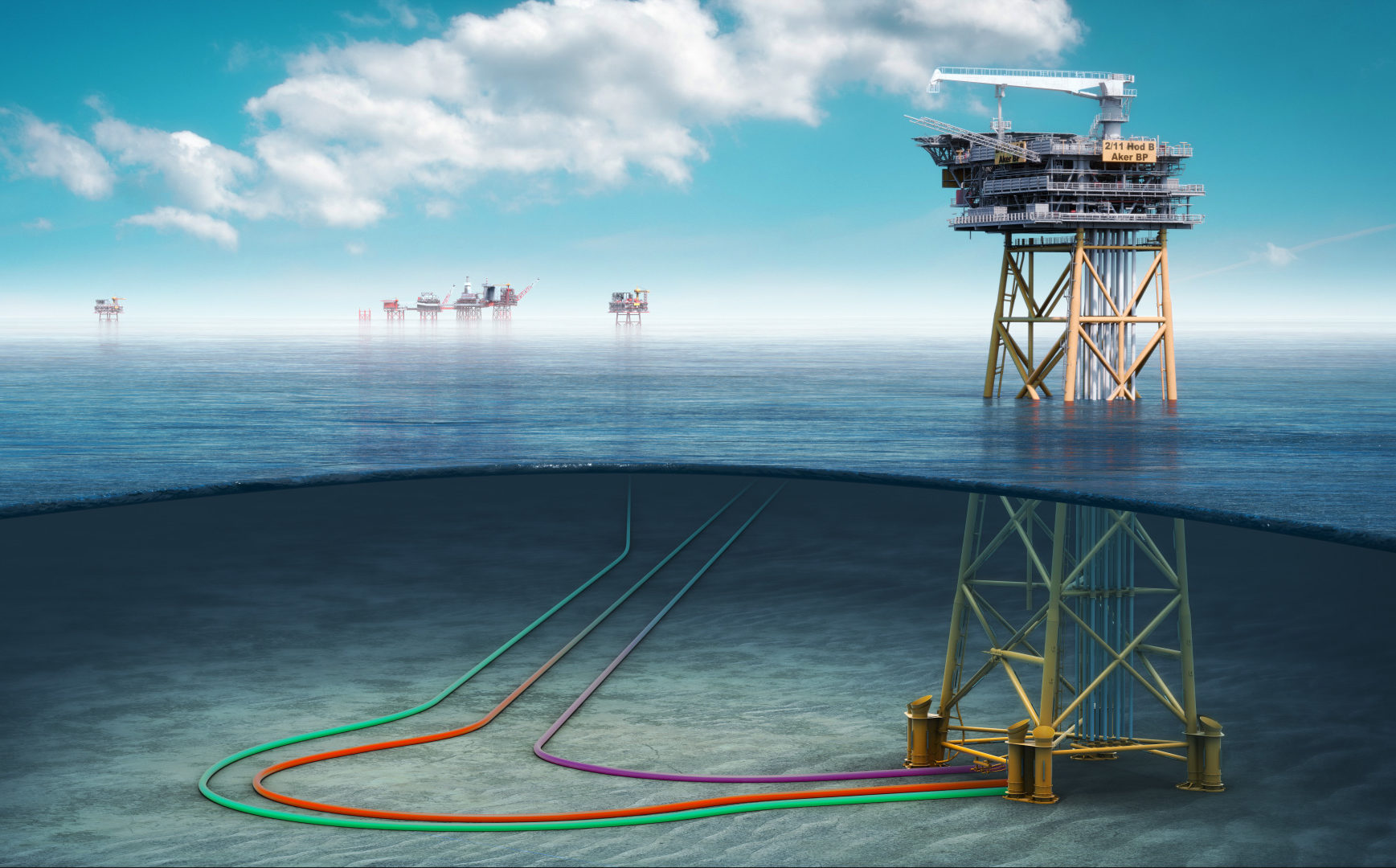

“The Slagugle discovery is a prime example of our exploration strategy targeting opportunities close to existing infrastructure with focus on prospects with material upsides. This is truly a great Christmas present and demonstrates the significant remaining resource potential on the NCS.”

The Slagugle well is the third discovery that Pandion Energy announces in 2020. In March, the company made an oil and gas discovery near the Balder field, in production license 820 S. The licensees are currently planning an appraisal campaign of this Iving discovery in 2021. In November, a minor gas discovery was announced in production license 263 D/E in the Norwegian Sea.

For further information see press release from the Norwegian Petroleum Directorate: Oil discovery north of the Heidrun field in the Norwegian Sea – 6507/5-10 S