Kerogen Capital is pleased to announce it has made an initial commitment of US$100 million to Pandion Energy AS (“Pandion Energy” or the “Company”), an exploration and production company focused on the Norwegian Continental Shelf (“NCS”). Pandion Energy will pursue exploration, appraisal and development opportunities on the NCS via acquisitions, farm-ins and licensing rounds. Kerogen, together with its limited partners, may commit up to US$300 million to Pandion Energy as its portfolio develops.

Pandion Energy, headquartered in Oslo, was formed to effect a management buy-out* of Tullow Oil Plc’s Norwegian subsidiary, Tullow Oil Norge AS. Kerogen will become its majority shareholder alongside the Pandion Energy management team. Pandion Energy’s strategy is focused on participating in discoveries with resource upside and enhancing their value through appraisal drilling, near field exploration and moving the assets up the development curve.

Pandion Energy’s strategy is focused on participating in discoveries with resource upside and enhancing their value through appraisal drilling, near field exploration and moving the assets up the development curve.

Proceeds from Kerogen’s investment will be used to build-out Pandion Energy’s portfolio, including funding the acquisition of all licences in Tullow Oil Norge AS’ existing portfolio*, as well as its operational platform. This transaction remains subject to approval from the Norwegian Ministry of Petroleum and Energy, and to the pre-qualification of Pandion Energy as a licensee on the Norwegian Continental Shelf.

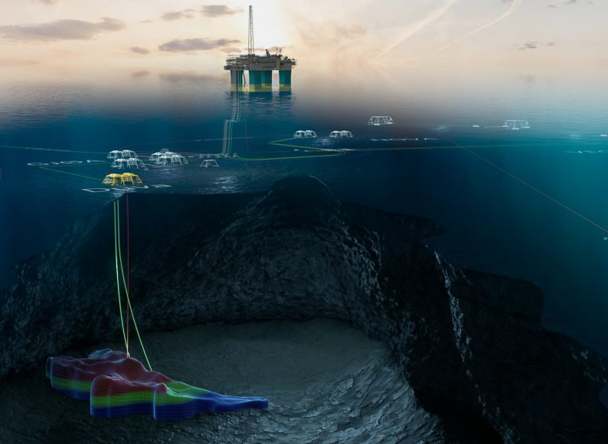

The initial portfolio includes a 20% interest in the Cara discovery made in September 2016 in PL 636. Cara is an attractive low breakeven oil and gas discovery with a preliminary mean resource estimate of approximately 50 mmboe located just 6km northeast of the existing Gjøa infrastructure in the North Sea.

The Pandion Energy management team has a long track record of technical, commercial and financial success in the NCS, having worked together for almost 10 years at Tullow Oil Norge AS and its predecessor, Spring Energy Norway AS, which was acquired by Tullow Oil Plc in 2013. The senior management team of Pandion Energy includes: Jan Christian Ellefsen, CEO; Bente Flakstad Vold, VP Exploration and Appraisal and Kjetil Steen, VP Development and Production. Helge Larssen Nordtorp, Deputy CEO and VP Business Development, and Hege Peters, VP Finance and Business Support, will be joining Pandion Energy management team upon transaction completion after fulfilling their current commitments to Tullow Oil Norge AS. Further detail is provided below.

Kerogen’s Co-Founder and Managing Partner, Jason Cheng, commented:

“We are excited to partner with the highly experienced Pandion Energy management team to develop the Cara discovery and to capitalise on the many attractive opportunities we currently see in Norway. Kerogen remains attracted to the North Sea given recent market dynamics, combining attractive pricing for assets, substantial reductions in operating cost structures and Norway’s low risk stable fiscal environment.”

Pandion Energy’s CEO, Jan Christian Ellefsen, commented:

“Following a period of reduced investment, we see a compelling case for the Norwegian Continental Shelf. With Kerogen as a partner, we are now able to mature our portfolio while acting swiftly on attractive opportunities in the asset market. Having worked close to 10 years together, I have great confidence in the Pandion Energy team and its ability to deliver on its objectives. We look forward to the journey that lies ahead.”

Profile of the Management Team

- Jan Christian Ellefsen (CEO) leads the Pandion Energy management team with 27 years of managerial, commercial and technical experience in oil and gas industry. Jan Christian joined Spring Energy just after the start-up and has, since May 2015, been responsible for all Tullow’s activities in Norway as Managing Director of Tullow Oil Norge AS. He has a background from both oil services and E&P companies, mainly within development and operations.

- Helge Larssen Nordtorp (Deputy CEO and VP Business Development) joined Tullow Oil Norge AS in 2015. Previously a Director of DNB Markets, a leading Norwegian investment bank, with 18 years of experience spanning capital market transactions, M&A and business development projects focused on oil and gas in Norway. Previously he was with the Norwegian Ministry of Petroleum and Energy.

- Bente Flakstad Vold (VP Exploration and Appraisal) previously responsible for all exploration activities and portfolio management at Tullow Oil Norge AS. She has 19 years of experience in oil and gas exploration and geophysics focusing on the North Sea, Norwegian Sea and Barents Sea. Prior to Tullow and Spring Energy, she worked for DNO and RWE Dea.

- Kjetil Steen (VP Development and Production) was team leader for Field Development at Tullow Oil Norge AS. He has 21 years of experience with developments on the NCS and West Africa, in particular taking discoveries to Final Investment Decision with focus on technical feasibility, concept selection, and engineering design through to execution.

- Hege Peters (VP Finance and Business Support) had overall management responsibility for accounting and financial control at Tullow Oil Norge AS. She has 22 years of experience from a variety of finance functions, managing accounting, budgeting, liquidity, tax and compliance processes. She initially qualified at Arthur Andersen as a Senior Auditor.

___

* Includes assignment of participating interests in the following licences on the Norwegian Continental Shelf: PL 636 (Cara discovery), PL 651, PL 689, PL 746 S, PL 750, PL 750 B, PL 774, PL 774 B, PL 776, PL 786, PL 791 and PL 826.